Chicago Green Fees Rise in 2025, Driven by Premium Course Hikes and New Cart Tax

An exclusive GolfScout analysis of 200+ Chicago-area golf courses reveals dramatic shifts in 2025 pricing

Published July 27, 2025

By Staff Report

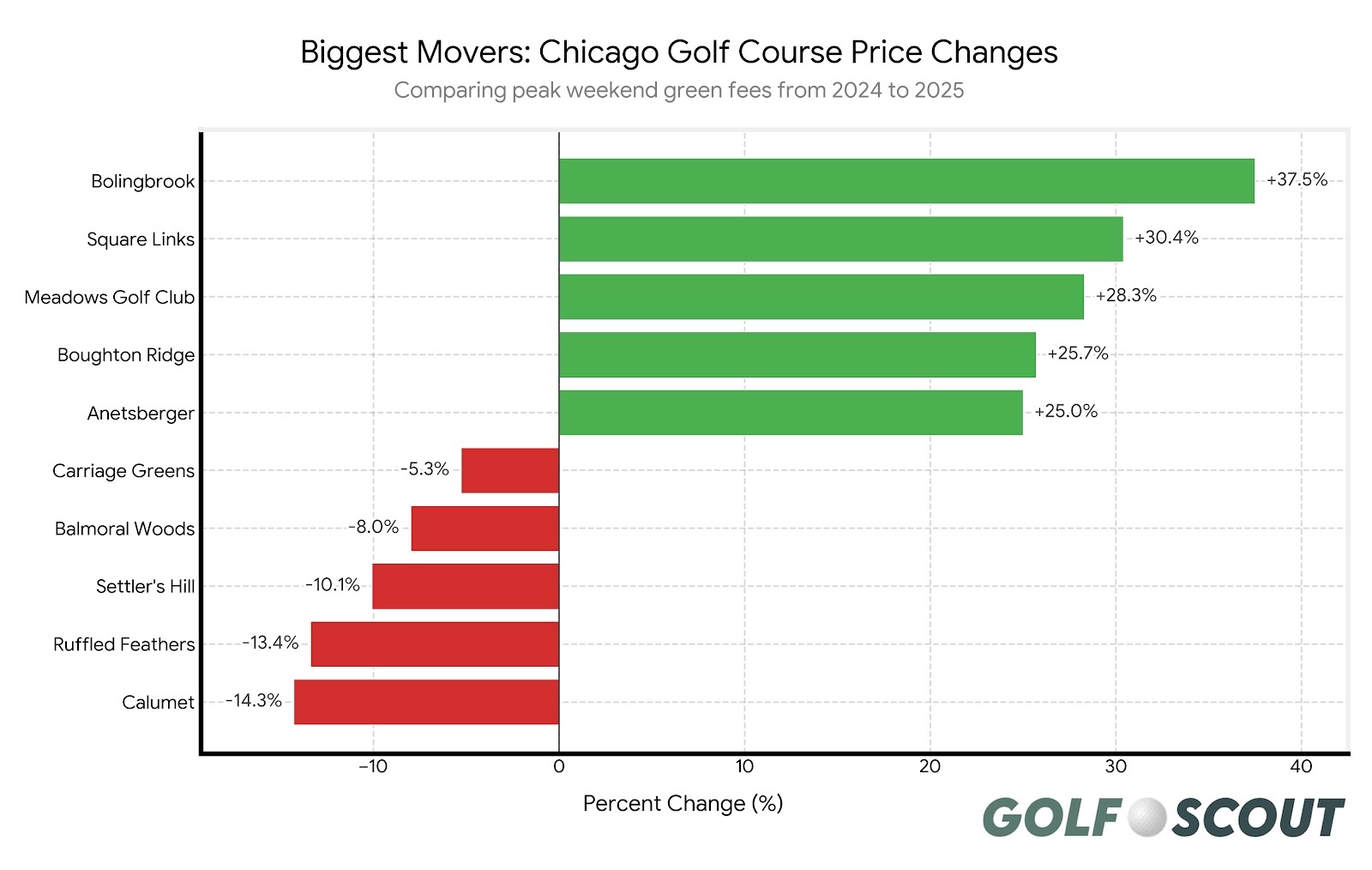

CHICAGO - The Chicago golf landscape saw significant pricing upheaval in 2025, with course fees swinging from double-digit decreases to jaw-dropping increases of nearly 40%. After manually collecting peak pricing data from over 200 courses in our database, clear patterns emerge that tell the story of an industry grappling with everything from poor course conditions to ambitious renovations and new state tax policies.

To see the complete list of Chicagoland green fee prices, visit the sortable Golf Cource Price Tracker.

The Big Picture: A Mixed Bag

Of the courses with complete 2024-2025 data, pricing changes ranged from a 14.3% decrease to a staggering 37.5% increase. However, over 33 courses held their prices steady with no change from 2024 to 2025, suggesting many operators are taking a wait-and-see approach in an uncertain market. Furthermore, another 33 courses raised prices only notionally with up to a 3% boost.

The average price for all courses in 2024 was $67, and in 2025 that figure rose to $71. The average price increase across all courses was modest at around 6%, which outpaced inflation. But this figure masks the dramatic swings at some individual facilities.

When Poor Conditions Meet Market Reality

Calumet Country Club led the price-cutting parade with a dramatic 14.3% decrease, dropping peak fees from $77 to $66. This once-private Donald Ross-designed course has struggled with conditioning issues and lack of investment; the price reduction appears to be management's acknowledgment that golfers won't pay premium prices for substandard conditions. The property developer that owns the land has other plans for the real estate here.

Close behind, Ruffled Feathers slashed prices by 13.4%, from $127 to $110. Once considered a premier Chicago-area facility, Ruffled Feathers has faced persistent criticism over deteriorating bunkers, poor overall maintenance, and mixed priorities as a venue. The significant price cut signals an attempt to rebuild its customer base.

Settler's Hill rounds out the top three price decreases at 10.1%, dropping from $79 to $71. Despite recent renovation efforts, golfers continue to complain about scruffy fairways, rough greens, and poorly maintained bunkers. The price reduction suggests the course understands the reality of the rebuild that supply and demand were not in line. A new management company, Landscapes Golf, hopes to address these concerns.

The Renovation Premium: Big Investments, Bigger Price Tags

On the opposite end of the spectrum, courses that invested heavily in renovations are commanding premium prices, sometimes with dramatic results.

Canal Shores (now officially known as The Evans represents the most extreme example of renovation pricing. After being closed for much of 2023 and 2024 for an extensive renovation, the course reopened with peak fees jumping from $48 in 2023 to $79 in 2025, a massive increase that reflects both the investment made, high anticipated demand, and the facility's improved product.

Winnetka Golf Club followed a similar path, closing for 19 months in 2023 and 2024 for a huge renovation and emerging with peak fees rising from $74 in 2023 to $99 in 2025. Both courses are betting that golfers will pay significantly more for improved conditions and amenities.

The LIV Effect: Tournament Prestige Comes at a Price

Bolingbrook Golf Club posted the single largest price increase among continuously operating courses, jumping 37.5% from $120 to $165. This dramatic hike appears directly tied to the course's hosting of the LIV Golf Chicago tournament, which featured superstars like Bryson DeChambeau and Jon Rahm. Management is clearly banking on the perceived prestige and media attention from hosting a major professional event to justify the premium pricing.

The Illinois Cart Tax Impact

A new wrinkle affecting 2025 pricing is Illinois's implementation of an 8.5% sales tax on golf cart rentals, effective January 1, 2025. This tax on cart rentals, pull carts, and club rentals has created additional complexity in pricing structures across the region.

Many courses have passed this cost directly to consumers, though the implementation varies widely. Some courses have absorbed the cost, others have raised cart fees specifically, and still others have built the anticipated tax impact into their overall green fee structure. This inconsistency makes direct price comparisons more challenging and may explain some of the modest increases seen across multiple facilities.

The tax particularly impacts weekend morning golfers, as many courses require cart usage during peak times regardless of a player's preference to walk.

Premium Courses Hold Steady

Interestingly, many of the region's most expensive courses showed durable price stability. Cog Hill's Dubsdread maintained its $204 peak fee, while The Glen Club increased only marginally from $219 to $220. This suggests that truly premium facilities with strong reputations have pricing power that allows them to avoid the dramatic swings seen elsewhere in the market.

The Dynamic Pricing Challenge

The complexity of modern golf pricing cannot be overstated. Dynamic pricing systems, similar to airline seat pricing, mean that the cost of a Saturday morning round can vary dramatically based on the time of day, day of the week, when you book, the weather, and other demand patterns. This system makes it increasingly difficult for golfers to budget and compare courses effectively, let alone gather consistent pricing data across all Chicagoland courses. Dynamic pricing isn’t new, but it has become far more widespread.

Our methodology focused on capturing true "peak pricing", the highest price a course charges for its most desirable times. In most cases, this means Saturday morning tee times booked with a few days advance notice. However, the dynamic nature of these systems means actual prices paid are likely to vary significantly from our peak price data. Such is the reality of the modern golf course economy. As always, the lowest green fees are going to be early and mid-week in off-peak hours. Twilight golf can be your friend too.

Looking Ahead: Market Correction or New Normal?

The 2025 pricing data reveals a golf market in transition. Courses with quality issues are being forced to compete on price, while those investing in improvements are betting golfers will pay premiums for better experiences.

The spread in pricing changes, from -14.3% to +37.5%, suggests the market is still finding equilibrium in the post-pandemic golf landscape. Courses that fail to maintain quality standards face pricing pressure, while those that successfully differentiate themselves through renovations, tournament hosting, or exceptional maintenance can command premium rates.

For Chicago-area golfers, this creates both opportunities and challenges. Bargain hunters can find significant value at courses that have cut prices, though they should be prepared for potentially subpar conditions. Meanwhile, those seeking premium experiences will face steeper price tags but potentially better overall value through improved facilities and services.

Methodology Note

This analysis represents the third year of comprehensive pricing data collection across 211 Chicago-area courses in the GolfScout database. Pricing data was collected manually through course websites and direct contact, focusing on peak weekend morning pricing. Dynamic pricing systems and the new Illinois cart tax created additional complexity in data collection, and some price variations may reflect differences in how courses present their pricing structures rather than actual changes in the cost to play.

For a complete list of Chicago-area public course green fees, visit the sortable Golf Cource Price Tracker.

Chicago Area Golf News, Updated Everyday

January 7, 2026 - Coyote Run Golf Course sets a new record for rounds playedJanuary 4, 2026 - Groups hope to save Calumet Country Club as a golf destination; owner says plan is impossible

January 4, 2026 - Golfers brave frigid temps Saturday at annual winter tournament in Des Plaines

January 3, 2026 - Zigfield Troy Golf Course par-3 course has closed

January 3, 2026 - Polar Bear Open to kick off St. Andrews' 100th anniversary celebration

More Chicagoland golf news

Anetsberger Golf Course

Apple Orchard Golf Course

Arboretum Club

Arlington Lakes Golf Club

Arrowhead East Course

Arrowhead South Course

Arrowhead West Course

Balmoral Woods Golf Club

Bartlett Hills Golf Club

Belmont Golf Club

Big Run Golf Club

Billy Caldwell Golf Course

Bittersweet Golf Club

Blackberry Oaks Golf Course

Blackstone Golf Club

Bliss Creek Golf Course

Bloomingdale Golf Club

Bolingbrook Golf Club

Bonnie Brook Golf Course

Bonnie Dundee Golf Club

Boone Creek Golf Club - Creekside Course

Boone Creek Golf Club - Prairie Course

Boone Creek Golf Club - Valley Course

Boughton Ridge Golf Course

Bowes Creek Country Club

Brae Loch Golf Club

Bridges of Poplar Creek Country Club

Broken Arrow Golf Club - East Course

Broken Arrow Golf Club - North Course

Broken Arrow Golf Club - South Course

Buffalo Grove Golf Course

Burnham Woods Golf Course

Calumet Country Club

Canal Shores Golf Course

Cantigny Hillside Course

Cantigny Lakeside Course

Cantigny Woodside Course

Cardinal Creek Golf Club - Center Course

Cardinal Creek Golf Club - North Course

Cardinal Creek Golf Club - South Course

Carriage Greens Country Club

Cary Country Club

Centennial Park Golf Course

Chalet Hills Golf Club

Chapel Hill Country Club

Chevy Chase Country Club

Chicago Heights East Golf Course

Chicago Heights West Golf Course

Chick Evans Golf Course

Cog Hill Course #1

Cog Hill Course #2 - Ravines

Cog Hill Course #3

Cog Hill Course #4 - Dubsdread

Columbus Park Golf Course

Countryside Prairie Course

Countryside Traditional Course

Coyote Run Golf Course

Craig Woods Golf Club

Crane's Landing Golf Club

Crystal Woods Golf Club

Deer Creek Golf Club

Deerfield Golf Club & Learning Center

Deerpath Golf Course

Eaglewood Resort Golf Club

Edgebrook Golf Course

Flagg Creek Golf Course

Foss Park Golf Course

Fountain Hills Golf Club

Fox Bend Golf Course

Fox Lake Country Club

Fox Run Golf Links

Foxford Hills Golf Club

Fresh Meadow Golf Club (Closed)

George W. Dunne National

Glencoe Golf Club

Glendale Lakes Golf Club

Glenview Park Golf Club

Glenview Prairie Club

Glenwoodie Golf Club

Golf Center Des Plaines

Golf Club of Illinois

Golf Vista Estates Golf Course

Grayslake Golf Course

Green Garden Blue Course

Green Garden Gold Course

Green Garden Links Course

Green Meadows Golf Course

Greenshire Golf Course

Harborside International - Port Course

Harborside International - Starboard Course

HeatherRidge Golf Course

Heritage Oaks Golf Club - Classic 18

Hickory Hills Country Club

Hickory Knoll Golf Course

Highland Woods Golf Course

Highlands of Elgin Golf Course

Hilldale Golf Club

Hughes Creek Golf Club

Indian Boundary Golf Course

Inwood Golf Course

Jackson Park Golf Course

Joe Louis “The Champ” Golf Course

Klein Creek Golf Club

Lake Bluff Golf Club

Lake Park Golf Course

Lincoln Oaks Golf Course

Links at Carillon - Blue Course

Links at Carillon - Red Course

Links at Carillon - White Course

Lombard Golf Course

Lost Marsh Golf Course

Makray Memorial Golf Club

Maple Meadows Golf Course

Marengo Ridge Golf Club

Marquette Park Golf Course

Meadowlark Golf Course

Meadows Golf Club of Blue Island

Midlane Country Club

Mill Creek Golf Club

Mistwood Golf Club

Mt. Prospect Golf Club

Naperbrook Golf Course

Nickol Knoll Golf Club

Oak Brook Golf Club

Oak Grove Golf Course

Oak Hills Country Club

Odyssey Golf Foundation

Old Oak Country Club

Old Orchard Country Club

Old Top Farm Golf Course

Orchard Valley Golf Course

Palatine Hills Golf Course

Palmira Golf Club

Palos Country Club

Palos Hills Golf Club

Phillips Park Golf Course

Pine Meadow Golf Club

Pinecrest Golf Club

Pistakee Country Club

Pottawatomie Golf Course

Prairie Bluff Golf Club

Prairie Isle Golf Course

Prairie Landing Golf Club

Randall Oaks Golf Club

Ravisloe Country Club

RedTail Golf Club

Renwood Golf Course

River Bend Golf Club

River Oaks Golf Course

Rob Roy Golf Course

Robert A. Black Golf Course

Ruffled Feathers Golf Club

Salt Creek Golf Club

Sanctuary Golf Course

Schaumburg Golf Club - Baer Course

Schaumburg Golf Club - Players Course

Schaumburg Golf Club - Tournament Course

Settler's Hill Golf Course

Seven Bridges Golf Club

Shepherd's Crook Golf Course

Shiloh Park Golf Course

Silver Lake North Course

Silver Lake Rolling Hills Course

Silver Lake South Course

South Shore Golf Course

Springbrook Golf Course

Square Links Golf Course

St. Andrews - Joe Jemsek Course

St. Andrews - St. Andrews Course

Steeple Chase Golf Club

Stonewall Orchard Golf Club

Stony Creek Golf Course

Streamwood Oaks Golf Club

Sugar Creek Golf Course

Sunset Valley Golf Club

Sydney R. Marovitz Golf Course

Tam O'Shanter Golf Course

Tamarack Golf Club

Tanna Farms Golf Club

The Glen Club

The Preserve at Oak Meadows

Thunderhawk Golf Club

Tuckaway Golf Club

Turnberry Golf Club

Twin Lakes Golf Club

Twin Lakes Golf Course

University Park Golf Club

Valley Ridge Golf Course

Vernon Hills Golf Course

Veterans Memorial Golf Course

Villa Olivia Golf Course

Village Green Golf Course

Village Greens of Woodridge

Village Links of Glen Ellyn - 18 Hole Course

Village Links of Glen Ellyn - 9 Hole Course

Water’s Edge Golf Club

Wedgewood Golf Course

Whisper Creek Golf Club

White Deer Run Golf Club

White Mountain Golf Park

White Pines East Course

White Pines West Course

Whitetail Ridge Golf Club

Wicker Memorial Park Golf Course

Willow Crest Golf Club

Willow Hill Golf Course

Wilmette Golf Club

Wing Park Golf Course

Winnetka Golf Club

Woodruff Golf Course

Zigfield Troy Golf